The recommended way to find lower priced car insurance rates in Long Beach is to compare prices regularly from insurance carriers that sell auto insurance in California. You can compare rates by completing these steps.

- First, spend some time learning about what is in your policy and the measures you can control to prevent expensive coverage. Many rating criteria that are responsible for high rates like speeding tickets, careless driving and a bad credit score can be amended by making minor changes to your lifestyle. Read the full article for additional ideas to find cheap prices and find additional discounts.

- Second, compare prices from direct, independent, and exclusive agents. Exclusive and direct companies can provide rates from a single company like GEICO or Farmers Insurance, while independent agencies can provide prices for a wide range of insurance providers.

- Third, compare the new rate quotes to your current policy to see if cheaper S2000 coverage is available. If you can save some money and switch companies, make sure there is no lapse in coverage.

- Fourth, notify your agent or company to cancel the current policy and submit a completed policy application and payment to your new company or agent. Don’t forget to store the certificate verifying proof of insurance in an easily accessible location in your vehicle.

One thing to point out is to make sure you enter the same coverage limits and deductibles on each quote request and and to compare as many companies as feasibly possible. This guarantees an accurate price comparison and the best price selection.

Amazingly, a recent NerdWallet.com study showed that nearly 70% of customers have purchased from the same company for at least four years, and about 40% of consumers have never taken the time to shop around. Most drivers in the U.S. could save almost $859 every year, but they just feel it’s too hard to find cheaper car insurance rates.

Amazingly, a recent NerdWallet.com study showed that nearly 70% of customers have purchased from the same company for at least four years, and about 40% of consumers have never taken the time to shop around. Most drivers in the U.S. could save almost $859 every year, but they just feel it’s too hard to find cheaper car insurance rates.

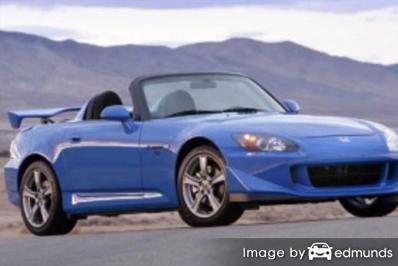

Which Honda S2000 insurance is cheapest in Long Beach, CA?

All the larger auto insurance companies such as GEICO, State Farm and Progressive provide insurance quotes directly from their websites. Obtaining pricing for Honda S2000 insurance in Long Beach is pretty painless as you simply type in your required coverages as detailed in the form. After you complete the form, the quote system obtains information on your driving record and credit history and generates a price.

Getting online price quotes for Honda S2000 insurance in Long Beach makes it simple to compare prices and it’s absolutely necessary to compare as many rates as possible if you want to get the best rate possible.

To get comparison pricing now, compare rates now from the companies shown below. To compare your current rates, we recommend you replicate the coverage information as shown on your current policy. This way, you will have a price comparison using the exact same coverages.

The companies shown below are our best choices to provide free quotes in Long Beach, CA. If your goal is to find cheaper auto insurance in California, we recommend you compare several of them in order to get a fair rate comparison.

Why you need quality insurance for your S2000

Despite the high insurance cost for a Honda S2000 in Long Beach, maintaining insurance is most likely required but also gives you several important benefits.

- Most states have compulsory liability insurance requirements which means you are required to buy specific minimum amounts of liability insurance if you drive a vehicle. In California these limits are 15/30/5 which means you must have $15,000 of bodily injury coverage per person, $30,000 of bodily injury coverage per accident, and $5,000 of property damage coverage.

- If you took out a loan on your Honda S2000, almost every bank will require that you buy insurance to protect their interest in the vehicle. If you let the policy lapse, the bank may insure your Honda for a lot more money and force you to reimburse them the higher premium.

- Car insurance preserves both your assets and your car. It will also provide coverage for medical transport and hospital expenses for both you and anyone you injure as the result of an accident. As part of your policy, liability insurance will also pay attorney fees if you are sued as the result of your driving. If you have damage to your Honda as the result of the weather or an accident, your policy will pay all costs to repair after the deductible has been paid.

The benefits of having car insurance definitely exceed the price paid, particularly if you ever have a claim. As of last year, the average driver in California overpays more than $750 every year so you should quote your policy with other companies at every policy renewal to save money.

Detailed coverages of your auto insurance policy

Having a good grasp of your auto insurance policy helps when choosing appropriate coverage and the correct deductibles and limits. Policy terminology can be difficult to understand and even agents have difficulty translating policy wording.

Protection from uninsured/underinsured drivers – This protects you and your vehicle from other motorists when they either are underinsured or have no liability coverage at all. Covered claims include injuries to you and your family as well as your vehicle’s damage.

Since many California drivers only carry the minimum required liability limits (15/30/5 in California), their limits can quickly be used up. For this reason, having high UM/UIM coverages is a good idea. Most of the time your uninsured/underinsured motorist coverages are similar to your liability insurance amounts.

Medical expense insurance – Coverage for medical payments and/or PIP pay for bills for prosthetic devices, rehabilitation expenses, EMT expenses and pain medications. They are often utilized in addition to your health insurance policy or if you do not have health coverage. It covers both the driver and occupants and also covers any family member struck as a pedestrian. PIP coverage is only offered in select states but can be used in place of medical payments coverage

Liability car insurance – This can cover damage or injury you incur to other’s property or people that is your fault. Split limit liability has three limits of coverage: per person bodily injury, per accident bodily injury, and a property damage limit. Your policy might show policy limits of 15/30/5 which means a $15,000 limit per person for injuries, $30,000 for the entire accident, and a total limit of $5,000 for damage to vehicles and property. Some companies may use a combined limit which provides one coverage limit with no separate limits for injury or property damage.

Liability coverage protects against claims like pain and suffering, repair costs for stationary objects, emergency aid and medical expenses. How much liability coverage do you need? That is your choice, but buy as much as you can afford. California requires drivers to carry at least 15/30/5 but you should think about purchasing better liability coverage.

The chart below shows why buying low liability limits may not be adequate.

Comprehensive (Other than Collision) – This coverage pays to fix your vehicle from damage from a wide range of events other than collision. You need to pay your deductible first then the remaining damage will be covered by your comprehensive coverage.

Comprehensive insurance covers claims like hitting a deer, hitting a bird, vandalism and a tree branch falling on your vehicle. The highest amount a auto insurance company will pay at claim time is the market value of your vehicle, so if your deductible is as high as the vehicle’s value consider dropping full coverage.

Collision coverage – This pays to fix your vehicle from damage resulting from a collision with another vehicle or an object, but not an animal. A deductible applies then the remaining damage will be paid by your insurance company.

Collision can pay for claims like scraping a guard rail, driving through your garage door and crashing into a building. Collision coverage makes up a good portion of your premium, so you might think about dropping it from vehicles that are 8 years or older. It’s also possible to raise the deductible on your S2000 in order to get cheaper collision rates.